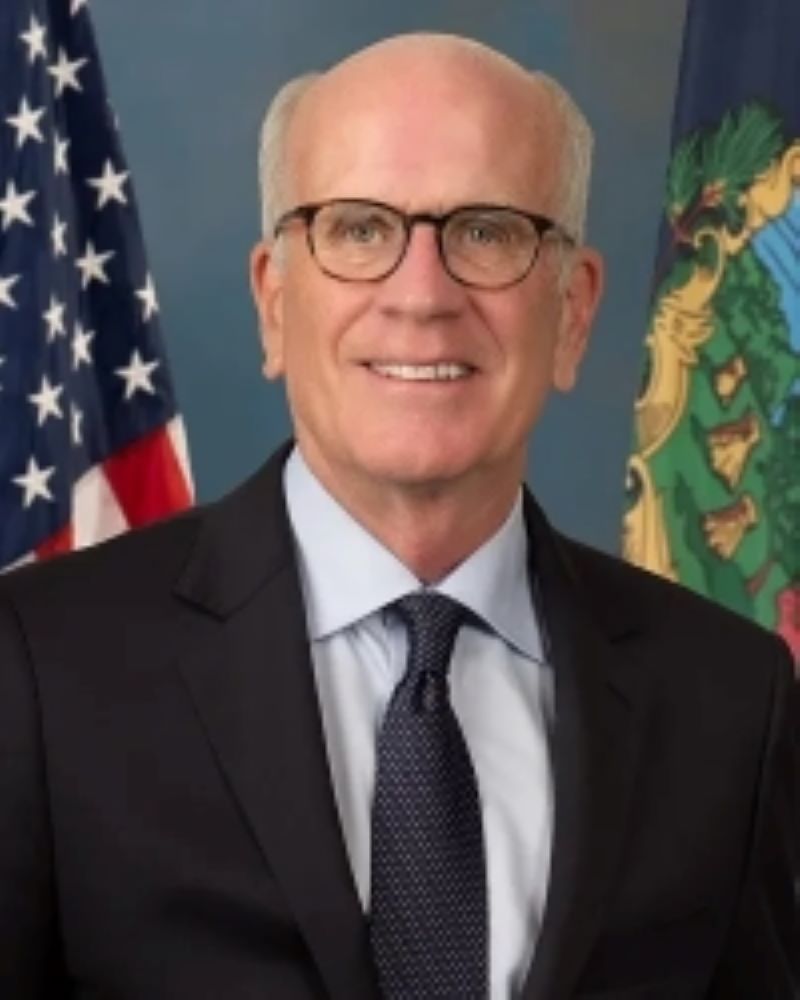

On Thursday, July 27, Senator Peter Welch of Vermont introduced new legislation with Congresswoman Chellie Pingree (D-Maine) and Rep. Joe Courtney (D-Conn) that would lower the cost of college for current and future students who borrow federal loans. This legislation would refinance how we currently accrue interest on federal loans for all current borrowers. It would also create a cap of interest for future borrowers.

“The Student Loan Interest Elimination Act will help ease the financial burden that unfairly comes with pursuing higher education and will work to reform the system that fostered this crisis in the first place,” said Congresswoman Pingree.

This fix would completely eliminate interest for 43 million Americans who currently are borrowing student loans. The interest rates for future borrowers would be on a sliding scale based on financial need. The vast majority would receive an interest rate of 0% and the maximum interest rate would be 4%.

The interest currently funds the operational costs of the federal student loan program. However, this legislation provides a way to offset eliminating the interest rates of so many students. The Department of Education would create a trust fund to pay for the operational costs of the program instead. Student loan borrowers will make payments on their principal balance that would then be put towards the trust fund.

On top of this, The Trustees would invest in various bonds with the student loan borrowers’ payments. These bonds include municipal bonds and Treasury bonds. The returns on these investments would also go towards the operational costs of the student loan program. This would save taxpayers from paying the bill while also allowing for the student borrowers to receive such low, if any, interest rates. The model of the trust fund mirrors other successful models used in federal programs such as the Federal Railroad Retirement Bond.

Any excess revenue under the Student Loan Interest Elimination Act would be put towards increasing the Pell Grant and other grants to support college competition and retention programs. The competitive grants would only go to institutions who have not raised their tuition by over 2% over the past three years.

The bill is endorsed by the American Association of Colleges and Universities, the Education Trust, and the Hildreth Institute.